@RAJAT_Zenith_685 yes working on enabling order editing for all order types including recurring orders.

We’re evaluating GTT orders. For now stop/limit orders should help achieve a similar outcome. They stay active for 90 days

@RAJAT_Zenith_685 yes working on enabling order editing for all order types including recurring orders.

We’re evaluating GTT orders. For now stop/limit orders should help achieve a similar outcome. They stay active for 90 days

XIRR feature?

year to date option for returns?

rupees converted return

Looks Cool! This will help me spend more time on the app without spoiling my sleep! I still see a gradient light at the top ![]() would still prefer a completely dark one like in the first image

would still prefer a completely dark one like in the first image ![]()

I would greatly appreciate it if the Vested team considers the following points.

1.XIRR Calculation for Individual Investments

•Implementing XIRR (Extended Internal Rate of Return) would provide a more accurate performance measurement for irregular cash flows.

•This can enhance investment tracking and decision-making for users.

2.Better Currency Conversion Rates

•Users are noticing better rates on other platforms using the same bank.

•Negotiating with the bank for competitive rates could improve user satisfaction and retention.

3.Displaying Active User Count

•Showing the number of active users would build trust and encourage referrals.

•A dynamic counter or periodic updates (e.g., “10,000+ active users”) could work well.

4.Official Facebook Page & USA News Updates

•Creating a Facebook page would allow users to engage with the platform beyond the app.

•Posting USA market highlights in a simple format could increase user interaction and attract new users.

5.Stock & ETF Ratio Comparison

•While users can compare stock returns over time, they need a feature to compare key financial ratios (P/E, ROE, Debt/Equity, etc.) across multiple stocks or ETFs.

•A side-by-side ratio comparison tool would be beneficial.

6.Stock & Business News Alerts

•List item Users request “Stock Alert” & “Product Launch Alert” for significant business news related to their stocks.

•Highlighting key updates when opening a stock page would improve engagement and decision-making.

Since I am planning to invest small amounts regularly for the long term, an auto debit feature from my bank account will be really helpful for setting up SIP.

Thank you so much for taking the time to share such detailed and thoughtful feedback!

Your points on XIRR calculations, better currency conversion rates, and a stock/ETF ratio comparison tool are incredibly valuable, and we understand how these features could enhance the overall investment experience. Even, your ideas on active user count transparency for the referral page, presence on Facebook, and stock alerts are great ways to improve engagement and trust.

Your input means a lot, and we’re always grateful for engaged users like you who help us shape the future of the platform.

Thanks again, and happy investing! ![]()

One basic feature missing is Alerts on US Stocks Price.

This must be present as this is core to an investment app.

Thanks for providing your inputs to improve the app @Sparsh_Nexus_827 . Our team is working on this and more features to make your US Investing experience even better.

The biometric unlock isn’t happening, it always says too many attempts and the counter doesn’t reset even upon resetting password.

+1 to this. It’s broken for me for a good month or more.

It will be better if u provide long term capital gains and short term capital gains. How many units are ltcg and stcg so that it will be easy if I want to sell without tax implications

Frankly speaking, indmoney has lot of features related to reporting like

1–ltcg,stcg,

2–What happens if I invest 1l in a share. returns for 1y,3y,5y and Comparison with benchmark and nifty50 for 1,3,5years

3-peer comparison

4-federal bank easy fund transfer option

5-no premium plans. Everything is free

6–capital gains sheet is provided yearly for previously and quarterly for current fy

Only thing that stopping people like me to invest through them is they lack sip support from wallet, vests and diy vests features.

So please provide reports in detail .reporting should be improved a lot.

Hi, I have been using Vested for 3-4 years now and will like to see following changes:

XIRR for each stocks and portfolio- While absolute returns are shown, probably XIRR is more relevant and helpful for investors for both portfolio and individual equities.

Return against total deposit- During deposit especially in INR there is deduction to convert to USD and further while buying equity there is a small charge. The returns showed are against investment but not against deposit. It will be useful if return against total deposit is shown

Hey @RAJAT_Zenith_685. Apologies for the inconvenience. We made some changes to resolve this for you. Could you please check if the issue continues to persist? Thanks.

@UNITY Apologies for the inconvenience. We made some changes to resolve this for you. Could you please check if the issue continues to persist? Thanks.

Why brokerage charged is not showing in monthly statement as expenses. It should be considered while calculating pnl and also for tax computation

@UDAY_Nexus_24 thank you for the feedback!

Please let us know if there’s anything else we can improve. Thanks!

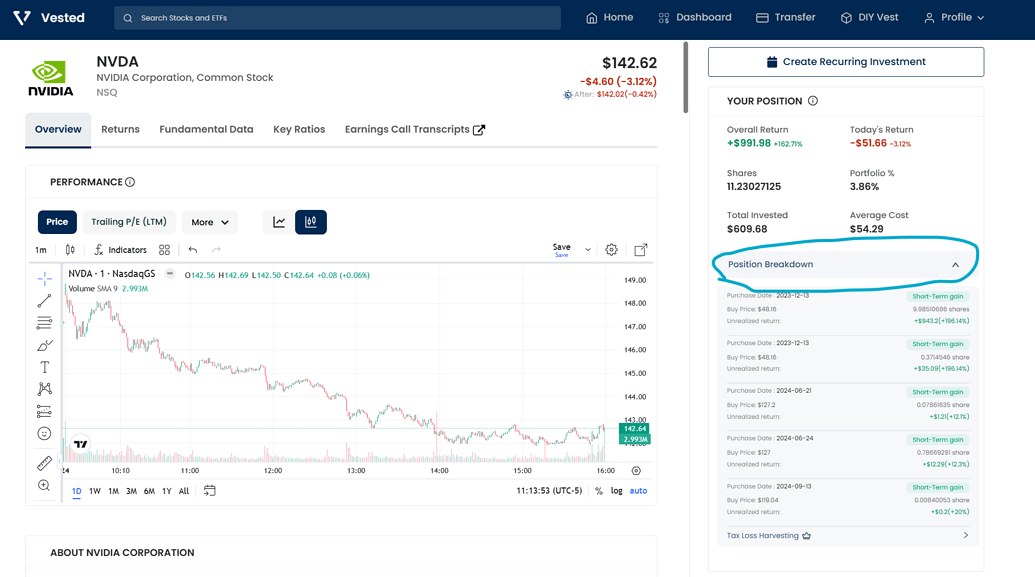

Regarding ltcg and stcg,

I had suppose 1000 transactions over 4 years. Will u be able to say how many units of a share is eligible for ltcg or stcg by looking at position breakdown.

Regarding peer comparison,

It will be better if it’s automated by system itself

Regarding premium plan, If harvesting tax module is present in free plan , it will help lot of investors as many people invest for diversification and need modules like this

Regarding fund transfer,

Banks like icici ,even though u added as preferred,still need to enter lot of details during fund transfer. Minimize the things that a investor need to add.

One more point

Why brokerage is not shown as expenses in tax filing documents. Give xls format like one to provide capital gains update latest

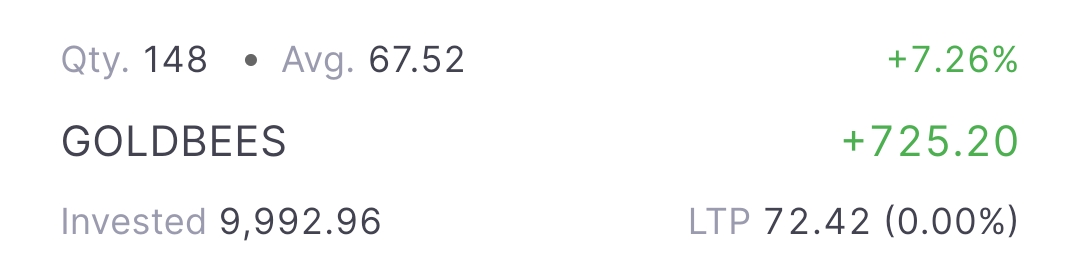

It will be good if it can be shown the details like this for all stocks.

Fix basic first… icici bank to fund is still not working… already nudging me to drive away from vested